Many employers provide employees with employer-paid group-term life insurance benefits or arrange for employees to purchase group-term life insurance benefits. Internal Revenue Code (Code) Section 79 includes the tax rules for employer-provided group-term life insurance.

Code Section 79 provides that an employee may exclude up to $50,000 of employer-provided group-term life insurance coverage from his or her taxable income. This tax exclusion applies only to insurance on the life of the employee. It does not apply to insurance on the life of the employee’s spouse or dependent or other individual.

Employers may provide employees with group-term life insurance coverage in excess of $50,000, but the excess cost of coverage is taxable to the employee. This excess cost is taxable even if employees pay the insurance premiums for the coverage.

This article answers many common questions regarding group-term life insurance benefits.

Commonly Asked Questions

Must the cost of employer-provided group-term life insurance be included in an employee’s gross income?

Pursuant to Code Section 79, an employee may exclude up to $50,000 of employer-provided group-term life insurance from his or her income. This tax exclusion applies only to insurance on the life of the employee. It does not apply to insurance on the life of the employee’s spouse or dependent or other individual.

In addition, the employer may generally deduct the premiums it pays for the coverage as an ordinary and necessary business expense, so long as the employer is neither directly nor indirectly the beneficiary under the policy.

May the employer provide group-term life insurance for its employees in excess of $50,000?

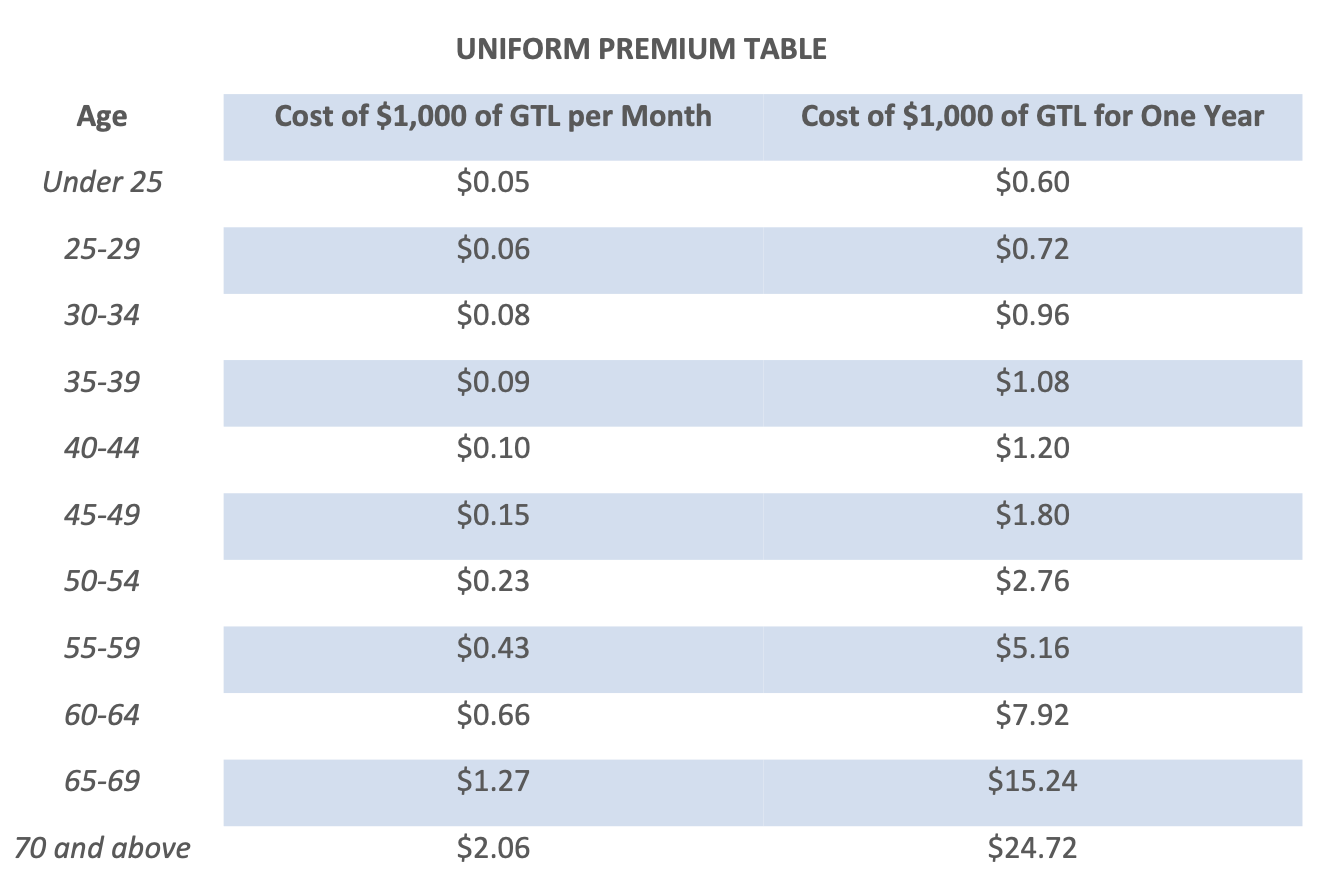

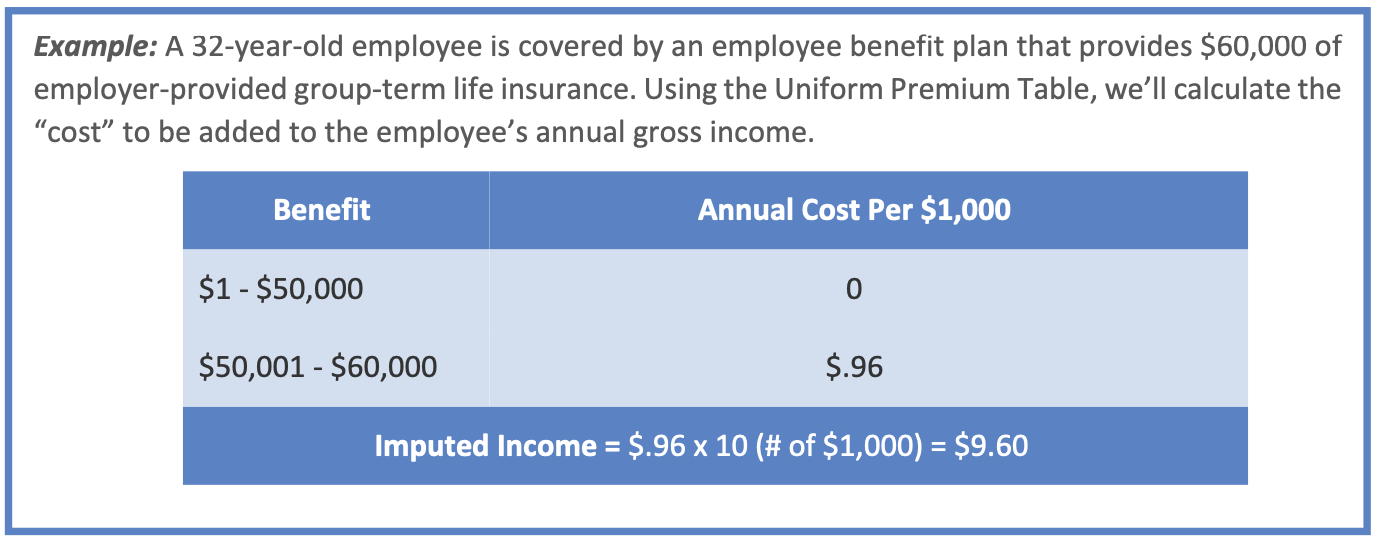

Yes. However, the “cost” of the coverage in excess of $50,000 must be included in the employee’s gross income. “Cost” as used here does not refer to the premium paid by the employer but to the cost determined under the Uniform Premium Table contained in IRS regulations. The “cost” of the coverage added to an employee’s gross income is commonly referred to as “imputed income.”

Can employees purchase group-term life insurance benefits with pre-tax dollars?

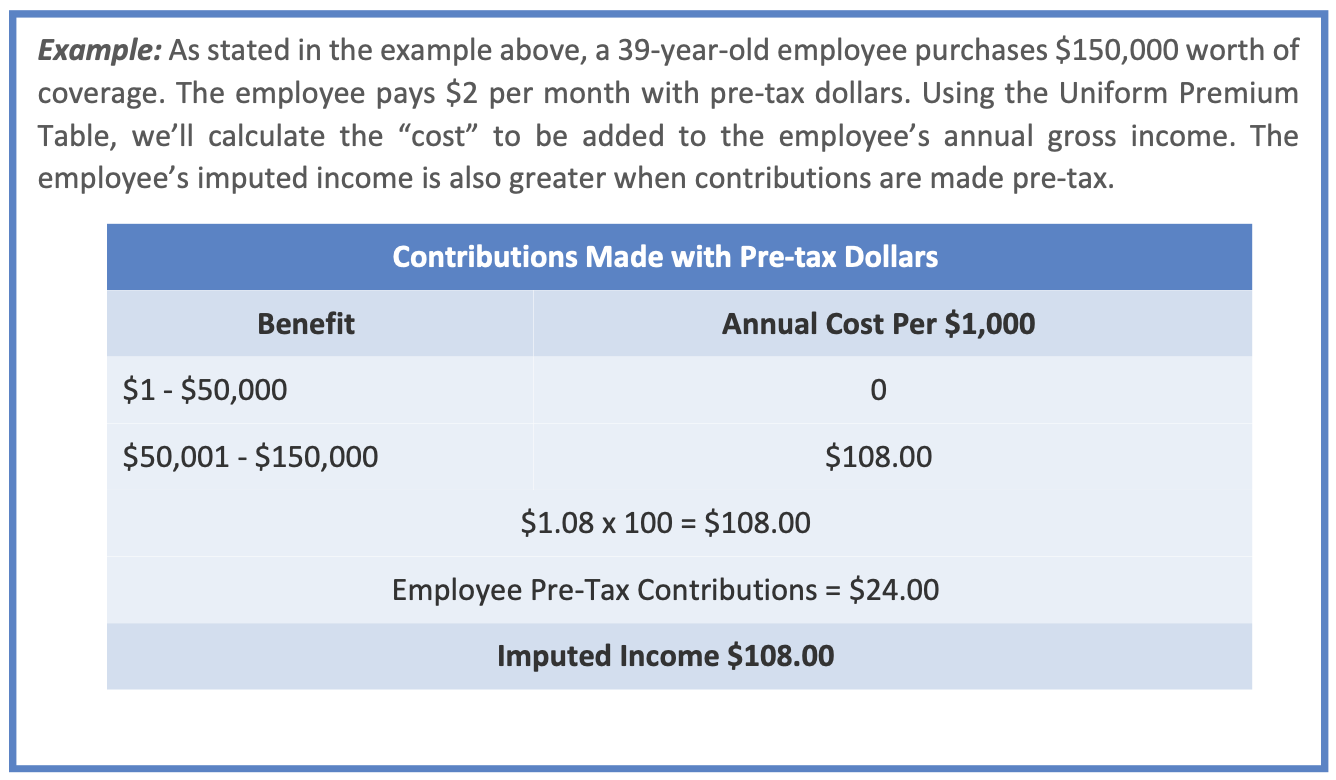

Yes, but only under a Code Section 125 cafeteria plan. Employees may purchase, with pre-tax dollars, up to $50,000 of group-term life insurance without having any “cost” of that coverage included in gross income. An employee may not use this exception if the employer has already provided up to $50,000 of employer-paid group-term life insurance benefits. In this case, amounts paid for the coverage through the cafeteria plan are excluded from employees’ income (regardless of the amount of coverage), but the cost of coverage in excess of $50,000 will be included in employees’ income based on the IRS’ Uniform Premium Table.

May employees purchase supplemental group-term life insurance benefits in excess of $50,000?

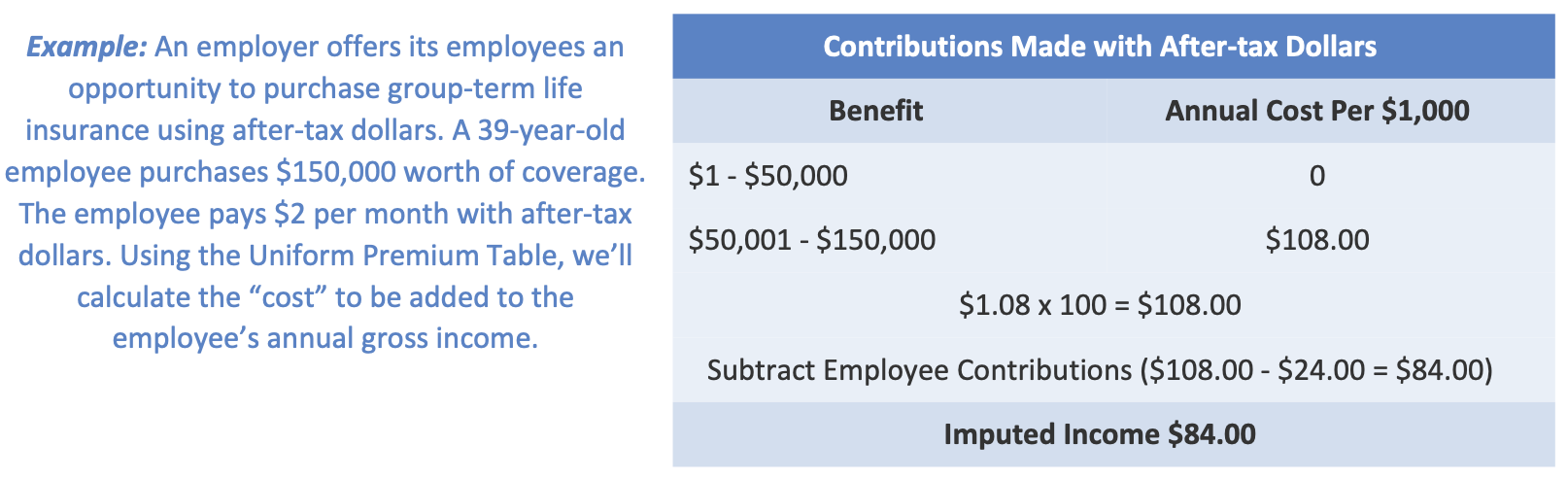

Yes, but the employee must include in gross income the “cost” of the excess coverage. As with employer-paid group-term life insurance in excess of $50,000, the “cost” is determined by using the IRS’ Uniform Premium Table. Even if employees pay for their coverage with post-tax dollars, they may have taxable income on the cost of coverage in excess of $50,000. This would occur if an employee’s post-tax contributions are less than the value of the excess coverage calculated using the IRS’ Uniform Premium Table.

May employees purchase group-term life insurance benefits in excess of $50,000 with pre- tax dollars?

Yes. Amounts paid for the coverage through a Code Section 125 plan are excluded from the employee’s income. However, the cost of coverage in excess of $50,000 is included in the employee’s income using the IRS’ Uniform Premium Table. Also, unlike with after-tax contributions, the employee’s imputed income under the IRS’ Uniform Premium Table is not offset by the employee’s pre-tax contributions.

What tax withholding requirements apply to imputed income for group-term life insurance coverage in excess of $50,000?

Employers must include in their employees’ wages the cost of group-term life insurance beyond $50,000 worth of coverage, reduced by the amount the employee paid toward the insurance on an after-tax basis. Employers should report the amount as wages in Boxes 1, 3 and 5 of the employee’s Form W-2 and show it in Box 12 with Code “C.” The amount is subject to Social Security and Medicare taxes. An employer may, at its option, withhold federal income tax.

Is there imputed income if the employer does not pay any cost of the group-term life insurance?

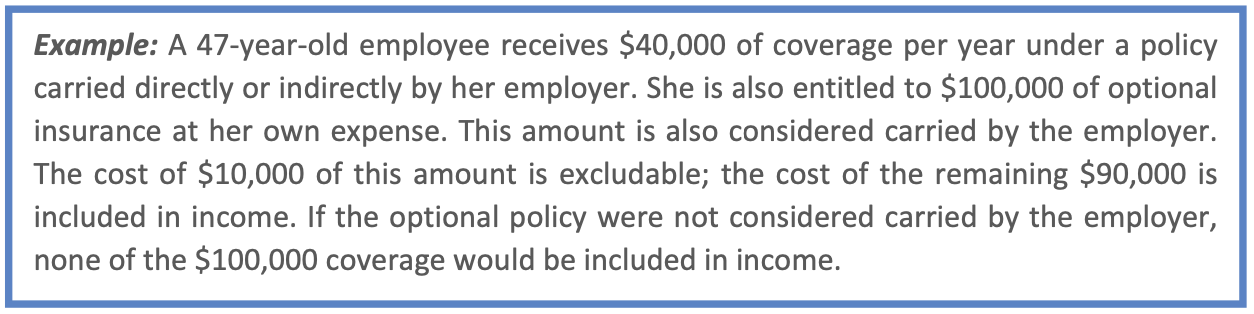

If the group-term life insurance policy is carried directly or indirectly by the employer, the IRS’ position is that the employer is affecting the premium, and, thus, there is a benefit to employees. The imputed income on coverage in excess of $50,000 is taxable to employees even if the employees are paying the full cost of the premiums charged.

A policy is considered carried directly or indirectly by the employer if:

- The employer pays any part of the insurance; or

- The employer arranges for the premium payments and the premiums paid by at least one employee subsidize those paid by at least one other employee (the “straddle” rule).

A policy that is not considered carried directly or indirectly by the employer has no tax consequences to the employee. Because the employees are paying the cost and the employer is not redistributing the cost of the premiums through an insurance system, the employer has no reporting requirements.

How can an employer allow its employees to purchase group-term life insurance coverage in excess of $50,000 and avoid the issue of imputed income?

An employer may avoid subjecting the supplemental group-term life insurance policy to Code Section 79 by offering two separate policies. The first policy would include the employer-paid coverage. This base policy would continue to be subject to Code Section 79. The second employee-pay-all policy would allow employees to purchase additional coverage with after-tax dollars. To avoid Code Section 79, the policy cannot be carried directly or indirectly by the employer. However, if one employee pays less than and one employee pays more than the Uniform Premium Table rates, this “straddling” will cause the policy to be treated as a policy “carried directly or indirectly” by the employer. In this case, the employer is responsible for imputing income.

What are the tax rules for group-term life insurance coverage for an employee’s spouse and dependents?

The cost of employer-provided group-term life insurance on the life of an employee’s spouse or dependent, paid by the employer, is not taxable to the employee if the face amount of the coverage does not exceed $2,000. This coverage is excluded as a de minimis fringe benefit. Whether a benefit provided is considered de minimis depends on all the facts and circumstances. In some cases, an amount greater than $2,000 of coverage could be considered a de minimis benefit. If part of the coverage for a spouse or dependents is taxable, the same Uniform Premium Table is used as for the employee. The entire amount is taxable, not just the amount that exceeds $2,000.

Are the proceeds from an employer-paid group-term life insurance policy taxable to the beneficiary?

No. Pursuant to Code Section 101(a)(1), life insurance proceeds are excluded from the beneficiary’s gross income for federal income tax purposes. However, this exclusion does not apply if the proceeds of the policy were transferred for valuable consideration.

When life insurance proceeds are not included in the employee’s income for federal income tax purposes, generally the proceeds are included in the employee’s estate and subject to federal estate taxes. With proper estate planning and the assistance of a tax consultant, it may be possible to avoid inclusion of life insurance proceeds within the decedent’s/employee’s estate.

Where an employee has paid the premiums for the group-term life insurance policy, the same tax treatment as stated above will apply.

What LG Risk Management Can Do for Your Organization

Contact Matt Glazer or call 631-589-6960 today about Group-term Life Insurance. Ask about doing an audit of all your business insurance policies so we can develop a customized plan that helps you attract and retain key employees.

Links and Resources

IRS Publication 15-B, Employer’s Tax Guide to Fringe Benefits

Internal Revenue Code Section 79

Treasury Regulation Section 1.79-3 (Uniform Premium Table)

Disclaimer: This article is provided by LG Risk Management for informational purposes only and is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice. ©2000-2011, 2013, 2015-2016 Zywave, Inc. All rights reserved.